Svasti's Fintech Solutions for Traditional Business Challenges.

The challenge for most financial services providers is that there is very little information available on customers' income, savings, credit, and spending patterns, and most of the low-income customers, especially women, are not digitally savvy app users.

"We have addressed the traditional challenges of the microfinance business by reimagining it with a unique amalgamation of well-designed processes and smart automation, using customised technology along with artificial intelligence and machine learning.

Svasti’s proprietary technology platform enhances our operational efficiency and risk management, while giving us invaluable insights into an undocumented and invisible customer segment.”

Narayanan Subramanian

Co-Founder, CFO & CIO, Svasti

THE TRADITIONAL CHALLENGES IN MICROFINANCE

(That Svasti’s Fintech is Designed to Overcome)

How do you know enough to ensure all risks are managed and controlled in a company that has 500 CRMs, and 2,00,000 customers, and whose numbers will continue to grow?

How do you optimise the efficiency of employee time and costs, as well as the accuracy of data that is collected, in an industry that’s based on unscripted human interactions?

How do you analyse and plan for a customer segment whose income, expenses, savings, assets, and aspirations, are largely undocumented?

FINTECH SOLUTIONS FOR TRADITIONAL CHALLENGES.

Technology Innovations, in a People-centric Business

SvasTech Processor is at the heart of the fintech at Svasti.

SvasTech Processor is a workflow engine that drives the entire origination and collection workflow in Svasti, and around which we have built all our other technology applications.

SvasTech Processor:

- Is used by all Svasti branch and audit staff

- Drives all Svasti on-field staff customer interactions

- Enables substantial point-of-activity data capture

- Enables full automation of process and documentation

- Helps Svasti enforce and implement business rules

SvasTech Profiler is at the front-end of Svasti’s fintech, and at the heart of every customer interaction at Svasti.

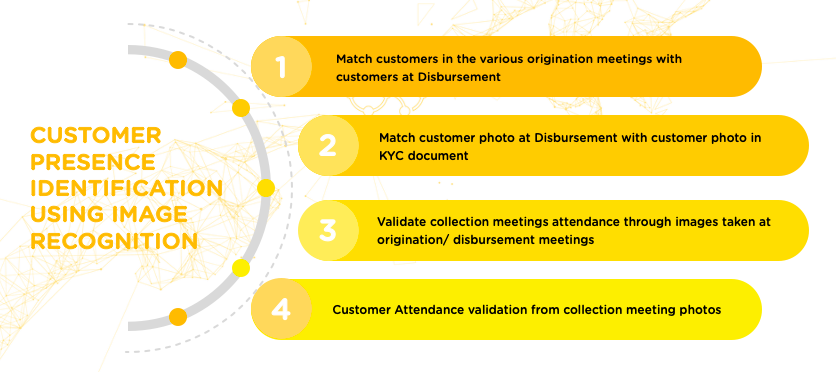

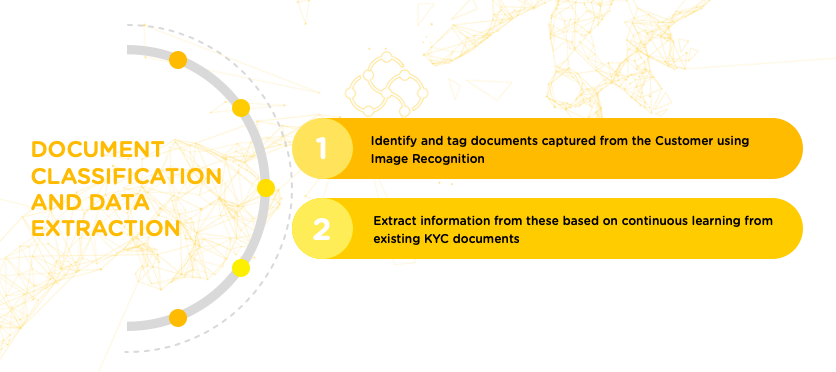

With SvasTech Profiler our CRMs know all the details they need to know about a customer (or prospect), during their interactions with them, including real-time digital KYC validation and Credit Bureau checks.

- It is woven into SvasTech Processor at appropriate workflow places

- Uses Machine Learning technology to extract data

- Has OCR and Face Recognition features

- Integrates with 3rd-party applications like Equifax

- Enables quick customer screening and decisions

This results in a transparent process, with short turnaround times, for customer evaluation and management.

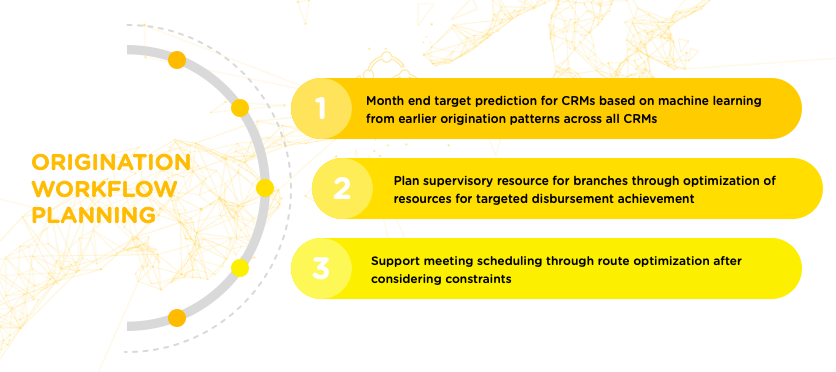

SvasTech Planner is a backend analytics engine that uses all the information we have in our database and provides various reports and analytics to our team.

- It is woven into SvasTech Processor at appropriate places in the workflow to give relevant information to the team to help their decisions.

- It processes, analyses, and presents information, and reports in various formats.

- It provides periodic customer and group credit ratings and scoring.

SvasTech Planner helps us make informed decisions in risk management, product development, and short and long-term business planning.

HOW SVASTECH PROFILER, PLANNER, AND PROCESSOR WORK TOGETHER.

ORIGINATION CONTROL AND MANAGEMENT

KYC AND CBC CHECK IN REALTIME

DISBURSEMENT PROCESS AND CONTROL

PLANNING AND SUPERVISION

COLLECTIONS AND INTERACTIONS

BRANCH MANAGEMENT

EVOLUTION OF SVASTI'S TECHNOLOGY FRAMEWORK.

HOW SVASTECH USES AI AND ML.

"Svastech is more than a technology platform, it is a powerful, dynamic, empowering business tool unmatched in the microfinance industry.

We’re very excited about its potentialand the possibilities that it opens up for us as we scale up our business year after year.”

Arunkumar Padmanabhan

Co-Founder & CEO, Svasti